- QUICKEN FOR MAC HELP MORTGAGE UPDATE

- QUICKEN FOR MAC HELP MORTGAGE FULL

- QUICKEN FOR MAC HELP MORTGAGE SOFTWARE

- QUICKEN FOR MAC HELP MORTGAGE CODE

- QUICKEN FOR MAC HELP MORTGAGE TRIAL

While many of our accounts offered free OFX support, there were a number that only worked with Direct Access, which is free during the generous 30 day trial period. In the register view, each entry is two rows, but the alternating background is also two rows, making it easy to see each transaction at a glance.īanktivity has two methods of data download: OFX (free) and Direct Access (subscription required). This view can also be infested with icons, but those can (thankfully) be disabled in the app's preferences. It looks very busy, but once you get into an account, the view is much cleaner than Moneydance: Its account list view is also laden with icons-folder icons, new activity count badges, and status badges. 2 - Banktivityīanktivity was a strong contender it was neck and neck with Quicken until I got more into the transition and looked closely at all of our accounts. This is true even if it's an account I just opened and then closed.ĭue to these issues, I quickly decided that Moneydance was not for me. Performance-wise, the app feels a bit slow it takes a couple of seconds to open an account in a new window after double-clicking its entry in the account list.

QUICKEN FOR MAC HELP MORTGAGE CODE

And while that doesn't inherently make it bad, Java's generic "write once for many platforms" code shows itself in a few places: The Preferences window doesn't look anything like a native Mac app window, and the buttons in the app are definitely not macOS-style buttons.

QUICKEN FOR MAC HELP MORTGAGE FULL

(It's easy to tell them apart in this four-line partial register, but in the full register with comments on the second line for many entries, everything blends together.) Notice that entries take up two rows, but the white/blue background alternates every other row…so if you're glancing at the register, it's nearly impossible to pick out one transaction unless you click on it to select it. I found the interface not to my liking-there are icons next to each account, which makes the layout look busy, and I found its register view confusing: This was the first app I looked at, and I pretty quickly ruled it out. Now, here's a brief overview of each of the three apps… 3 - Moneydance Still, these are relatively minor issues compared to successfully importing nearly 25 years worth of Quicken data. Banktivity won't import reconciliations, so none of my accounts were reconciled.

Moneydance ignored the "hidden" status of accounts, so a lot of old, closed accounts showed up. As such, I can't vouch for how well any of these three programs handle those tasks.Īll three apps imported my Quicken data file, though with varying degrees of success. Things I don't really care about are bill pay (I use our bank), reports, budgets, and charts and graphs for anything outside the investments section of the app.

QUICKEN FOR MAC HELP MORTGAGE UPDATE

QUICKEN FOR MAC HELP MORTGAGE SOFTWARE

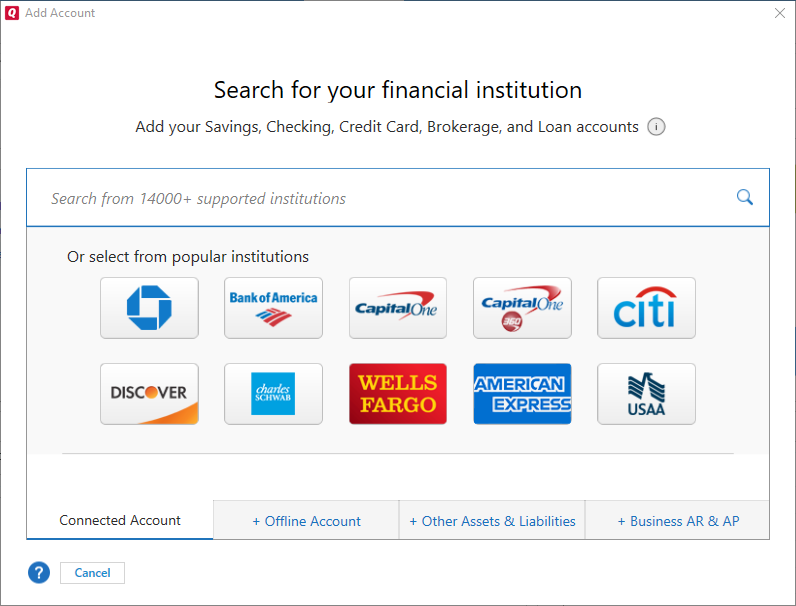

(I hate subscription software in general, but as it turns out, this one isn't really a subscription.) Going in, I was dead set against it, mainly due to its annual subscription structure. It was finally time to find its replacement.Īfter reviewing lists of alternatives-and asking on Twitter-I focused on three apps: Bantivity, Moneydance, and Quicken 2018 for Mac.Īfter looking at all three, I surprised myself by deciding that Quicken was the best tool for our use. Worst of all, it would crash on occasion, necessitating rebuilding all my data files. In addition to its 32bitness, it had other issues: The UI was tiny and horrid, the windows never opened where I closed them ( Moom's saved layouts to the rescue!), and online access to my accounts was nearly non-existent. Why? Basically because it worked (most of the time), and I didn't like any of the alternatives, which I would occasionally test. Yes, I was using an eleven-year-old app to track our family's spending and investments. I've been using Quicken in some form since 1994, but stopped with Quicken 2007-I found the newer versions worse than Quicken 2007, so I never upgraded. The coming of " not without compromise" 32bit app usage in the fall 2018 macOS release finally forced my hand: I was going to have to update my single longest-used app, Quicken 2007.

0 kommentar(er)

0 kommentar(er)